schedule B number or the harmonized tariff classification number to the sixth digit only. This can speed up the export clearance process as well as the import clearance in the buyer’s country since it provides a universal description of goods for duty and tax purposes.Īnother item that should be included is the destination control statement.

#INTERNATIONAL COMMERCIAL INVOICE PRO#

In addition to the information included on the pro forma invoice, the invoice may include the U.S. In short, you must issue a valid VAT invoice to charge VAT on sales or reclaim VAT that you’re charged for goods and services.

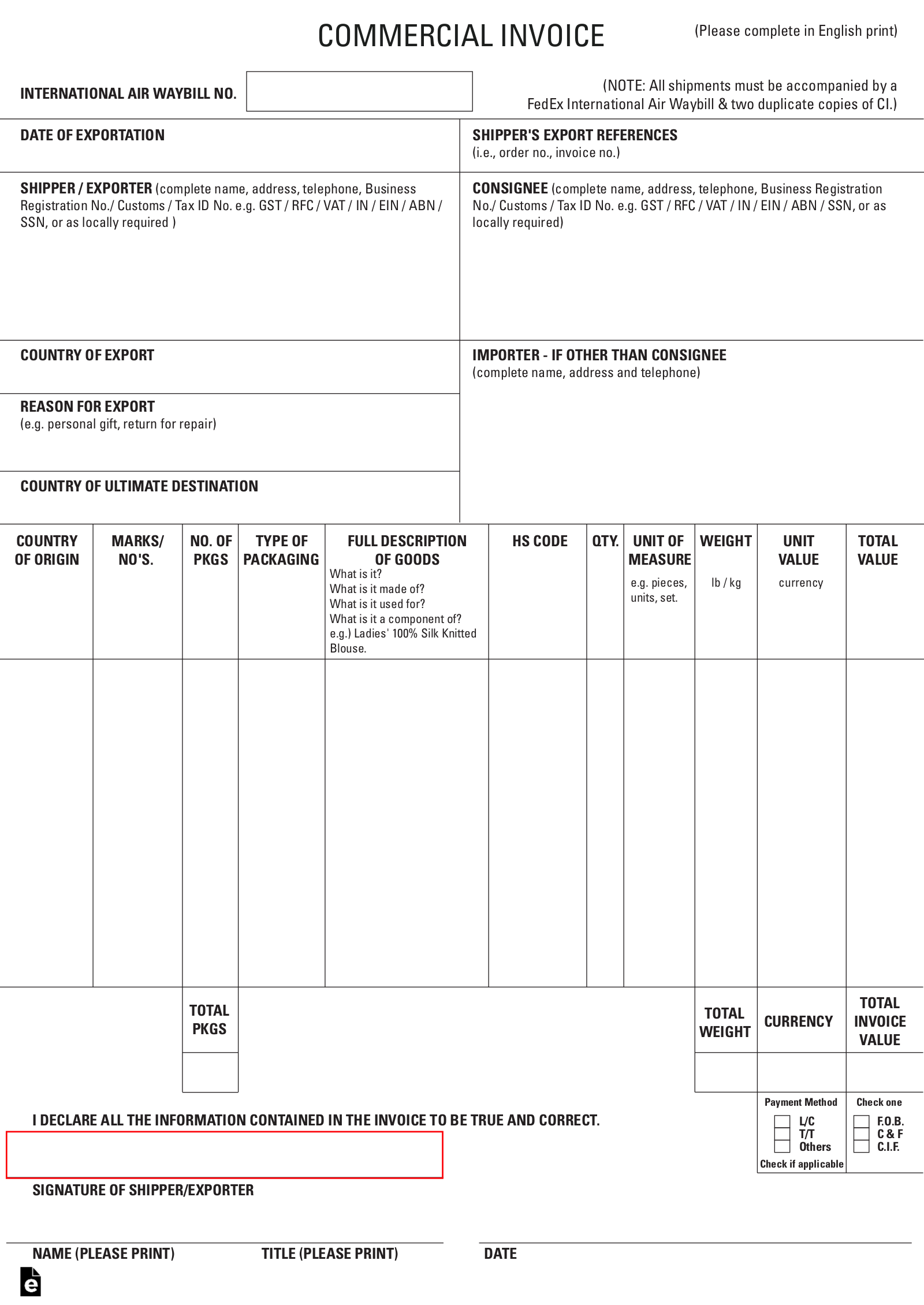

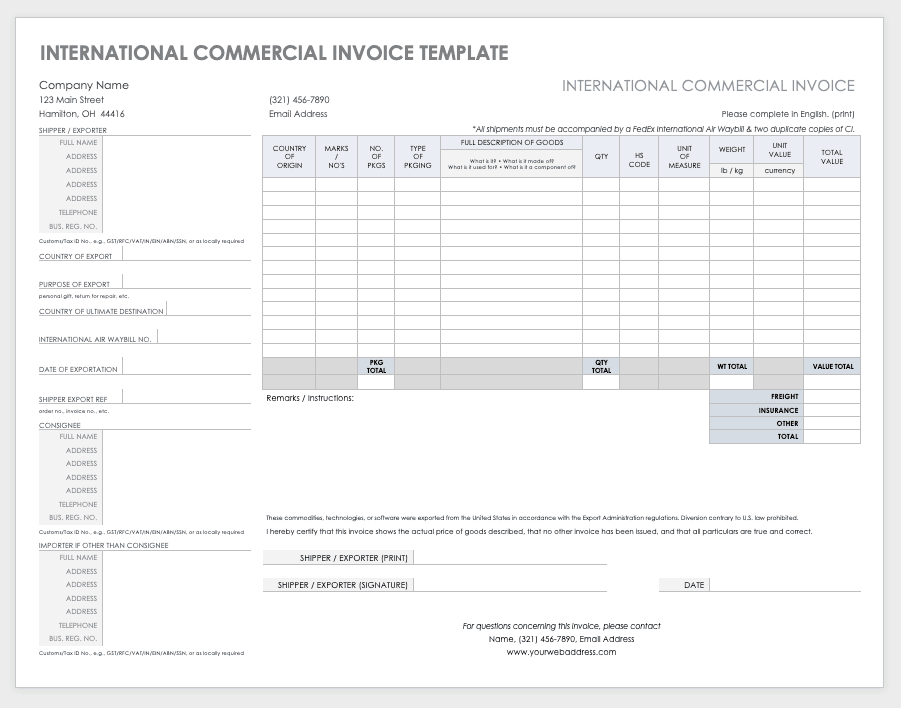

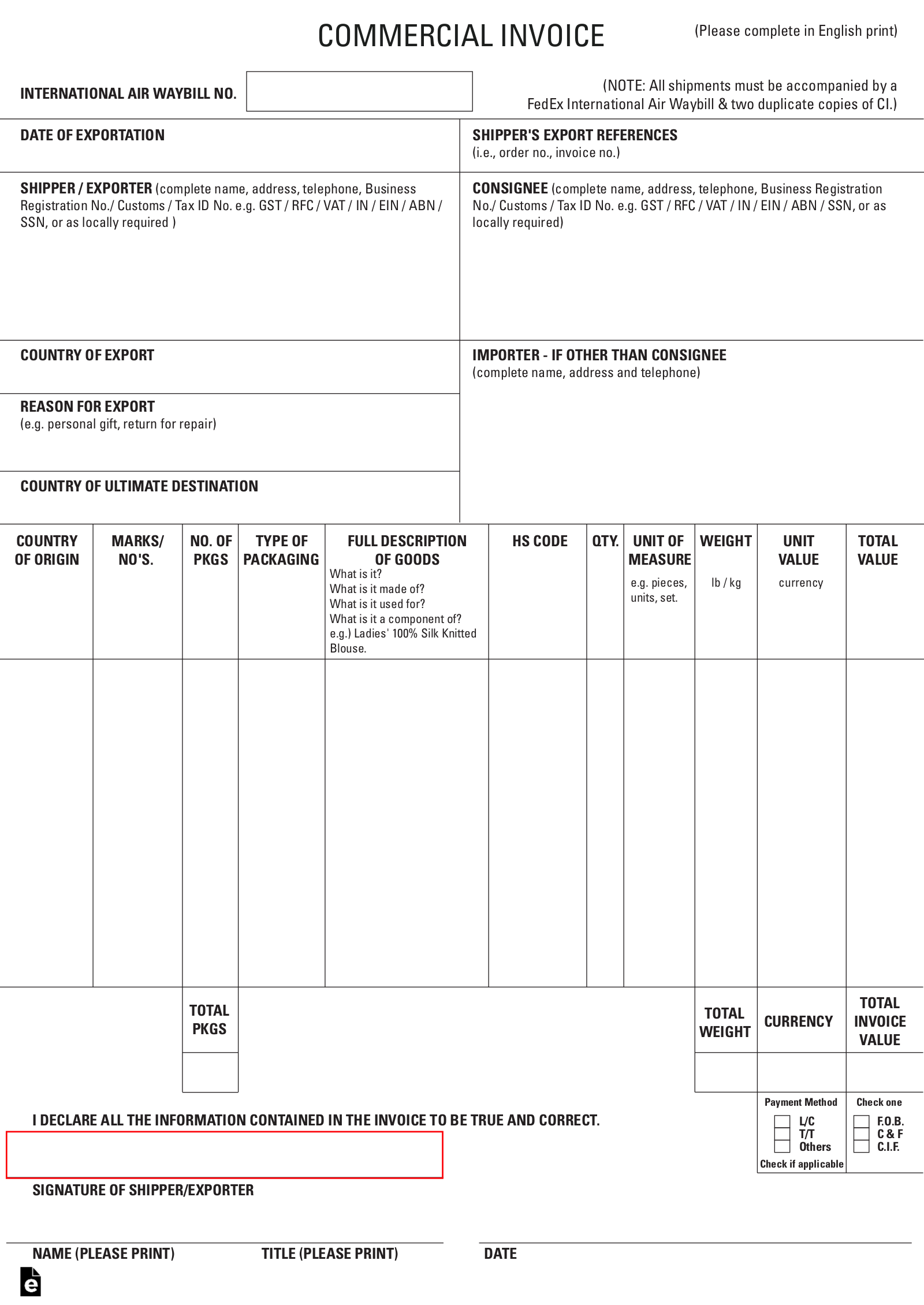

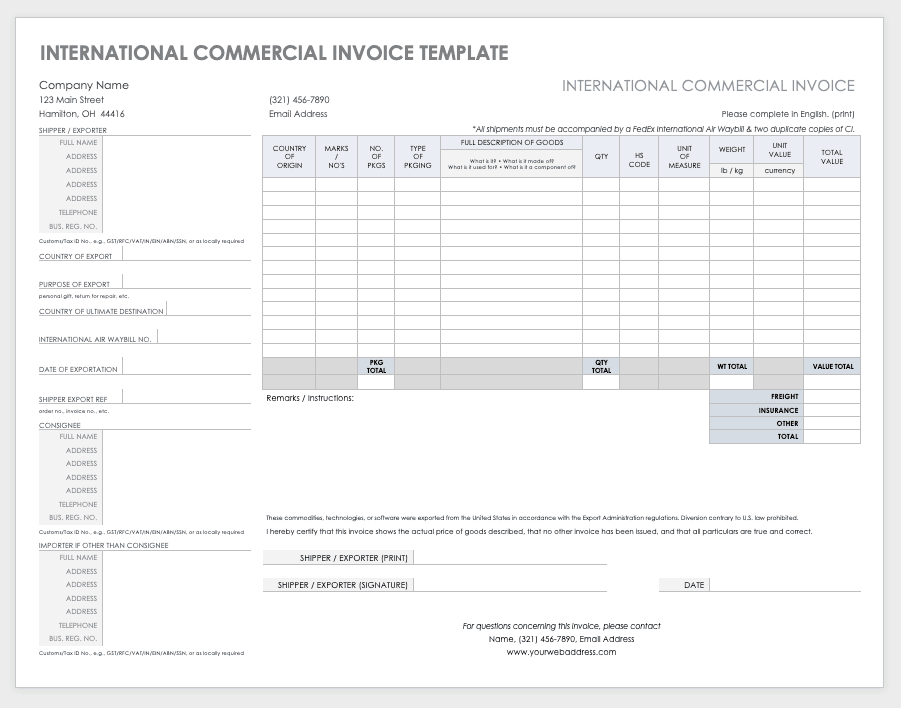

Economic Development Organizations (EDO)Ī commercial invoice is a required document for the export and import clearance process. It is sometimes used for foreign exchange purposes. In the buyer’s country, it is the document that is used by their customs officials to assess import duties and taxes.īefore completing a commercial invoice for a new export destination, it is advisable to consult reliable sources for country-specific requirements. A few countries require the invoice to be on a specific form, but for most countries, the seller or exporters version is acceptable as long as all the pertinent information is included. While a commercial invoice is simply the standard type of payment demand issued after the delivery of goods and services, VAT invoices have a much more specific purpose. It serves multiple purposes, including providing information about the shipment. The commercial invoice is the primary shipping document used by customs worldwide for commodity control and valuation, providing important instructions and information to: The freight forwarder U.S.

Foreign Direct Investment Attraction Events A commercial invoice is a crucial document in international trade.In the buyer's country, it is the document that is used by their customs officials to assess import duties and taxes. It is sometimes used for foreign exchange purposes. Facing a Foreign Trade AD/CVD or Safeguard Investigation? A commercial invoice is a required document for the export and import clearance process.

0 kommentar(er)

0 kommentar(er)